Q 11.1 Which of the Following Is True About Corporations

The following is true. The firm did a similar study 10 years ago in which 60 of a random sample of 160 salespeople wanted a self-improvement course.

Entered into the following transactions involving short-term liabilities.

. A a note pay- able for 100000 due in 2 years b a 10-year mortgage payable of 300000 payable in ten 30000 annual payments c interest payable of 15000 on the mortgage and d accounts payable of 60000. The corporation is an entity separate and distinct from its owners. 703 324-2665 wwwfairfaxcountygov.

Which of the following statements is true regarding by-products or scrap. In this case the HHI is 100 1 2 100. QS 11-1 Characteristics of corporations LO C1 Identify which of the following statements are true for the corporate form of organization.

A stockholder is personally liable for the debts of the corporation. Consequently 50000 of the income from the corporation would be taxed twice. Gibson Corporation manufactures three.

Stockholders wishing to sell their corporation shares must get the approval of other stockholders. Check one statement There are 10 or less shareholders anaall of the shareholders are listed below. A corporation is considering expanding operations to meet growing demand.

In this case the HHI is 16 2 10 2 8 2 7 6 2 8 3 2 744. You may select more than one answer. Process costing is the only method that should result in by-products or scrap.

It decreased working hours and increased leisure time for most Americans. With the capital expansion the current accounts are expected to change. To the best of my knowledge and belief.

Calculate the HHI for the industry shown in Table 1. It created a large number of high-paying factory jobs for workers. Required information Problem 11-1A Short-term notes payable transactions and entries LO P1 The following information applies to the questions displayed below Tyrell Co.

A stockholder is personally liable for the debts of the corporation. They find a negative value of the test statistic and a p-value of 093. You may select more than one answer Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer.

It led to less pollution and overcrowding in areas where most people lived. Which of the following is true of a dividend payout. For each obligation indicate whether it should.

Problem P11-8A Do It11-1 Indicate whether each of the following statements is true or false. The groups are assumed to be independent random samples. To protect individual What does the Federal Deposit Insurance Corporation do.

Iij Ii I 111 14 I Office of the County Attorney Suite 549 12000 Government Center Parkway Fairfax Virginia 22035-0064 Phone. Management expects cash to increase by 20000 accounts receivable by 40000 and inventories by 60000. 20 Purchased 38000 of merchandise on credit from Locust terms n30.

Which of the following is true about corporations. The corporations life is stipulated in its charter. Joint costs occur after the split-off point in a production process.

Stockholders acts can bind the corporation even though the stockholders have not been appointed as agents of the corporation. The corporations life is stipulated in its charter. Stockholders acts can bind the corporation even though the stockholders have not been appointed as agents of the corporation.

Which of the following were the main proponents of Advantages corporations brought to the American consumer did Which of the following is an advantage corporations have Why were corporations formed. Question 11 1 point Suppose researchers draw a sample of 650 breakfast sandwiches from a certain fast- food restaurant and carry out a t test of the null hypothesis that the true mean sodium content is 700 against the alternative hypothesis that it is greater than 700. It improved productivity and made goods less expensive for consumers.

The liability of stockholders is normally limited to their investment in the corporation. There are more than 10 shareholders and all of the shareholders owning 10 or more of any class of stock issued by. The corporation would pay tax on the 100000 at corporate income tax rates and the shareholders would pay tax on the 50000 at each individual shareholders income tax rate.

A corporation randomly selects 150 salespeople and finds that 66 who have never taken a self-improvement course would like such a course. QS 11-1 Static Characteristics of corporations LO C1 Identify which of the following statements are true for the corporate form of organization. Calculate the HHI for an industry with 100 firms that each have 1 of the market.

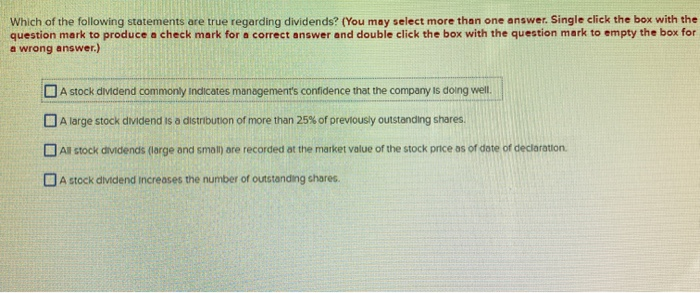

QS 11-1 Static Characteristics of corporations LO C1 Identify which of the following statements are true for the corporate form of organization You may select more than one answer Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Business Accounting QA Library BE11-1 Jamison Company has the following obligations at December 31. Andrea see E11-1 has studied the information you gave her in that exercise and has come to you with more statements about corporations.

Corporation management is both an advantage and a disadvantage of a corporation compared to a proprietorship. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong.

Enter Your Answers As A Comma Separated List In 2022 Answers List Enter

Enter Your Answers As A Comma Separated List In 2022 Answers List Enter

Solved Qs 11 1 Characteristics Of Corporations Lo C1 Chegg Com

No comments for "Q 11.1 Which of the Following Is True About Corporations"

Post a Comment